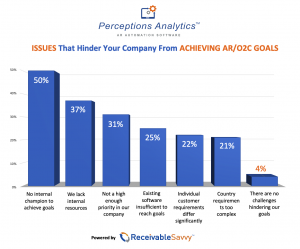

It’s no secret that many businesses face challenges when meeting goals and objectives around their accounts receivable (AR) and order-to-cash (O2C) processes. In fact, the struggle is so widespread that 50% of companies say they have no internal champion to help them reach their goals, 37% lack internal resources, 31% believe it’s not a high enough priority in their company, and 25% say their existing software is insufficient to help them achieve their goals.

We’ll dive into the reasons behind these challenges and offer actionable insights on overcoming these obstacles and optimizing your AR and O2C processes, driving better cash flow and overall business performance.

The Struggle is Real

Accounts receivable and order-to-cash are critical components of any business’s financial health. When managed effectively, they can help streamline operations, reduce the risk of bad debt, and improve cash flow. However, many companies need help optimizing these processes, often stemming from lacking internal support and resources.

No Internal Champion (50%)

Having an internal champion—a dedicated individual or team focused on driving improvements in AR and O2C processes—can make a world of difference in a company’s ability to meet its goals. However, a staggering 50% of companies report that they lack this crucial support.

Solution: Identify and empower an internal champion, whether an individual or a small team, to take ownership of AR and O2C process improvements. This individual or group should deeply understand the organization’s financial systems and be empowered to make data-driven decisions designed to help improve processes. By having a designated internal champion, companies can ensure that AR and O2C optimization remains a consistent priority, with ongoing support and resources.

Lack of Internal Resources (37%)

Many companies are constrained by limited internal resources, which can hinder their ability to achieve their goals in AR and O2C processes. This can include insufficient staff, inadequate training, or inadequate tools.

Solution: Evaluate your current resources and identify areas where additional support or investments are needed. Consider reallocating resources or investing in new tools and training to help your team work more efficiently and effectively. Outsourcing specific tasks or partnering with external experts can also help bridge the gap in internal resources.

Not a High Enough Priority (31%)

For some organizations, AR and O2C processes don’t reach the top of the priority list. This can result in inefficient systems, slow collections, and an increased risk of bad debt.

Solution: Educate senior leadership on the importance of optimizing AR and O2C processes for the organization’s overall financial health. This can be accomplished by crafting compelling executive communications, conducting impactful meeting presentations with relevant and convincing data, or strategic face-to-face meetings. By illustrating the potential impact on cash flow and profitability, you can elevate the priority of these processes within the company and ensure they receive the attention they deserve.

Insufficient Software (25%)

Outdated or inadequate software can significantly hinder a company’s ability to optimize AR and O2C processes. It can lead to errors, bottlenecks, and a lack of visibility into key performance indicators.

Solution: Evaluate your existing software and identify any limitations holding your organization back. Consider investing in new, more advanced software to streamline your AR and O2C processes, automate repetitive tasks, and provide real-time insights into your financial performance. When selecting a software solution, look for features such as automated invoicing, payment tracking, and customizable reporting to help your team work more efficiently and make data-driven decisions.

Overcoming the challenges associated with accounts receivable and order-to-cash processes is crucial for any organization looking to improve cash flow and overall financial performance. Businesses can drive meaningful improvements in their AR and O2C operations by identifying and empowering an internal champion, allocating appropriate resources, prioritizing these processes, and investing in the right software solutions.

The steps mentioned earlier can also foster a culture of continuous improvement and financial excellence. This, in turn, can lead to more substantial cash flow, reduced risk of bad debt, and ultimately, increased profitability and long-term success.

Remember, optimizing your AR and O2C processes is not a one-time effort but an ongoing commitment to refining and enhancing your financial operations. Embrace this journey, invest in the right tools and people, and prioritize these critical aspects of your business. Doing so will help you achieve your financial goals and position your company for sustained growth and success.