For the uninitiated, the perception about business is that every executive quickly embraces leading technology designed to streamline their operation, leading to greater efficiency and more revenue. In this version of business, everyone lives happily ever after. While that’s a very romantic notion, nothing could be further from the truth. Some leaders operate on the bleeding edge, implementing technology designed to transform their businesses radically. It’s also true that most are slow to embrace the type of technology that will successfully streamline processes and increase revenue.

Chief Financial Officers, those responsible for managing the financial actions of a company, are chief among those who resist technology designed to transform their business. Let me be clear: not every CFO or financial leader is slow to embrace technology. Some lead the technology charge in their organizations, but that is typically the exception rather than the norm. One of the glaring illustrations regarding many CFOs being slow to embrace technology is that many still find value in having their organizations submit paper invoices.

The CFO’s Role

The CFO holds a critical role within an organization, managing everything from financial planning and cash flow to analyzing the company’s financial health. Like any other executive role, the CFO oversees many areas that are critical to the organization’s well-being. With that said, there is a difference between highly effective CFOs that truly lead their organizations and leverage transformative technology and those that are capable financial executives but don’t have a comfort level and vision to see their organizations technologically transformed.

Much data suggests the company CFO, with a wide selection of advanced solutions at their disposal, embraces 20th Century solutions. The question is why.

What the Data Tells Us

To illustrate where a CFO might continue to embrace obsolete processes, we can look at what our Perceptions Analytics study tells us around invoice submission.

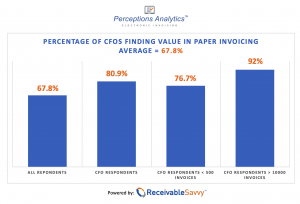

To set the baseline, we must acknowledge that many organizations using electronic invoicing still use paper to submit invoices. The Perceptions Analytics data shows that of those organizations submitting electronic invoices via third-party networks, 67.8% indicate they remain very satisfied with submitting invoices via paper. We’ve understood for a while that organizations, no matter their size or industry, still receive some value when submitting invoices via paper.

If that is a surprising piece of data, consider that when we isolate among CFOs who responded to our study, 80.9% indicate they are very satisfied with submitting paper invoices. How can the percentage of CFOs experiencing value from paper invoice submission be higher than the average of all other respondents? That’s a great question, but before we go there, it gets more interesting.

Among CFOs working for organizations that submit no more than 500 invoices per year, 76.7% are very satisfied with paper. That may sound reasonable, as the fewer the invoice volume, the easier it is to submit invoices via paper. When we look at CFO responses from those whose companies submit 10,000 or more invoices each year, a whopping 92% indicate they are very satisfied with paper.

This data suggests that digital transformation, especially as it relates to invoice submission and perhaps other financial activities, has a long way to go.

Why the CFO Still Embraces Paper Invoicing

Based on our research, there are several reasons paper invoicing remains prevalent.

- Paper invoicing leading to longer payment terms is acceptable if those terms are predictable and reliable.

- It’s relatively easy to submit invoices via paper. There is no mystery, no implementation process, and billing and accounts receivable staff can do it without overthinking it.

- When switching from paper invoicing to electronic invoicing, t

- here can be a serious change management undertaking that can go well beyond finance and accounting within the organization.

As I stated in a recent blog post, one of the challenges of electronic invoicing solution providers is making implementation easy for every type of supplier organization – especially those that don’t have IT resources devoted to network implementation.

Getting to the heart of the matter, why do CFOs in 2022 still find value in submitting paper invoices? The answer lies not necessarily in the notion that paper invoicing is superior to other forms of invoicing. We know that it’s not. The honest answer requires a much more comprehensive look at the overall issue.

- It’s not just about invoices. Whether large or small, organizations still submit a significant portion of their invoices via paper because a transition to digitization is akin to a comprehensive change management initiative. If invoices are digitized, what about product catalogs, credit analysis, collections, payment, and cash application? Many CFOs must consider digitizing other components of Order-to-Cash if considering streamlining invoicing. When this occurs, it involves more than just the CFO. A comprehensive digital transformation involves the CEO, CTO, CIO, CMO, and other executives and stakeholders who will be impacted – and who will benefit – from a digital transformation initiative.

- Electronic and paper Invoicing coexist. Another reason CFOs still find value in submitting paper invoices is that they have already digitized a large portion, or the majority, of invoices submitted to customers. There may be reasons why some invoices are submitted as paper, which often has to do with the customer and not the supplier. Trying to get customers to digitize is just as challenging as customers trying to digitize their supply chain. Some customers, even Fortune 1000 companies, hold on to antiquated practices regarding procurement and accounts payable processes.

- Costs associated with digital transformation. While it’s true that digitizing the invoice-to-pay process can reap significant savings long term, there is a cost associated with implementing this type of change. Many organizations find it challenging to budget for digital transformation on the front end of the invoice-to-pay process but remain content paying for the inefficiencies on the back end. It boils down to a choice: pay now or pay later. Many CFOs are choosing to pay later, partly due to balancing budgets today and not seeing those long-term benefits as something that will significantly benefit the organization soon enough.

How CFOs can transition from paper to electronic

There are several strategies CFOs can use to transition from paper to electronic successfully.

- Begin a finance-led digital transformation initiative. Many companies fear digital transformation. Admittedly, such an undertaking is difficult, but beginning with low-hanging fruit within finance can lead to a collaboration with other departments within the organization that need transformation.

- Collaborate with other departments. Partnering with other company executives in IT, HR, marketing, and sales to initiate a digital transformation initiative can benefit the entire organization. This strategy enables CFOs to have allies invested in the transformation who can also carry some of the operational and financial burden.

- Benchmark success elsewhere. Identify successful financial digital transformations and pick the brains of other CFOs who have successfully implemented initiatives that led to long-term economic benefits.

- Leverage technology. Consider solutions that use AI, machine learning, electronic invoicing, ERP, AR automation. Ideally, these components would be rolled into a tightly integrated solution delivered as one or multiple offerings that work well together.

CFOs, and the organizations they work for, really do require a comprehensive, 360 financial management system then enables them to master paperless invoicing and other processes that will ultimately contribute more revenue to the bottom line.

Embracing solutions such as Tradeshift or Tungsten Network for electronic invoicing, HighRadius or Billtrust for AR automation, and PrimeRevenue or Photon Commerce for payments can help CFOs streamline multiple components of their invoice-to-cash process and truly make paper invoicing a thing of the past.

Ernie Martin is Founder and Managing Director of Receivable Savvy. He brings over 25 years of experience in financial supply chain management, marketing and communications and draws upon his extensive experience to share knowledge and best practices with AR professionals. He previously chaired the Vendor Forum of the Federal Reserve Bank of Minneapolis and his resume includes time at several well-known brands and companies such as Tungsten Network, Delta Airlines, CIGNA Healthcare and Georgia Pacific as well as a number of years as an independent consultant.